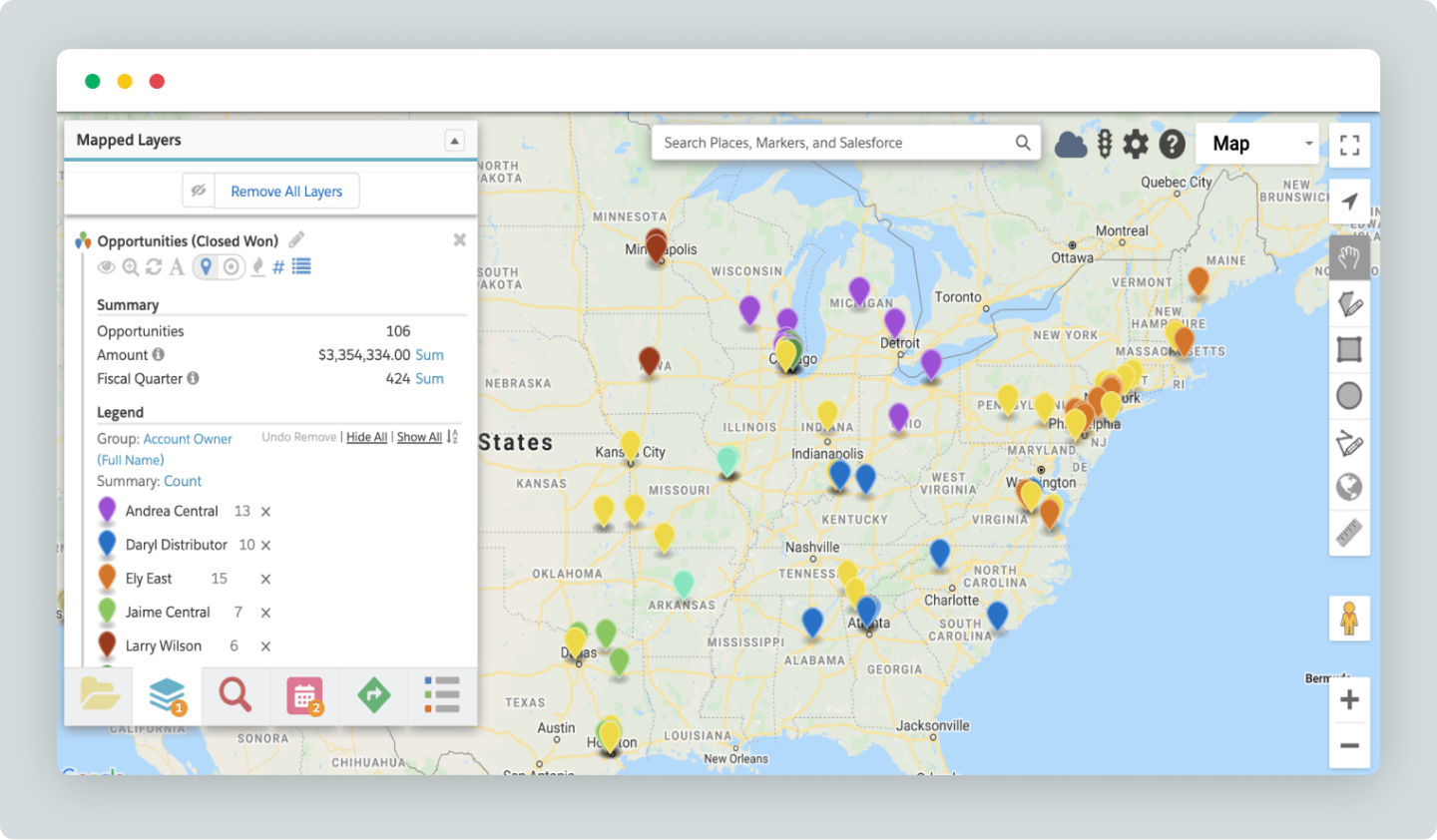

Location intelligence can be used to help drive the fast-paced Financial Services industry. Geolocation allows you to visualize concentrations of policies, optimize scheduling and routes to client meetings, and easily track AUM. Enhance your offerings with location intelligence for Salesforce to provide the best customer experience possible.

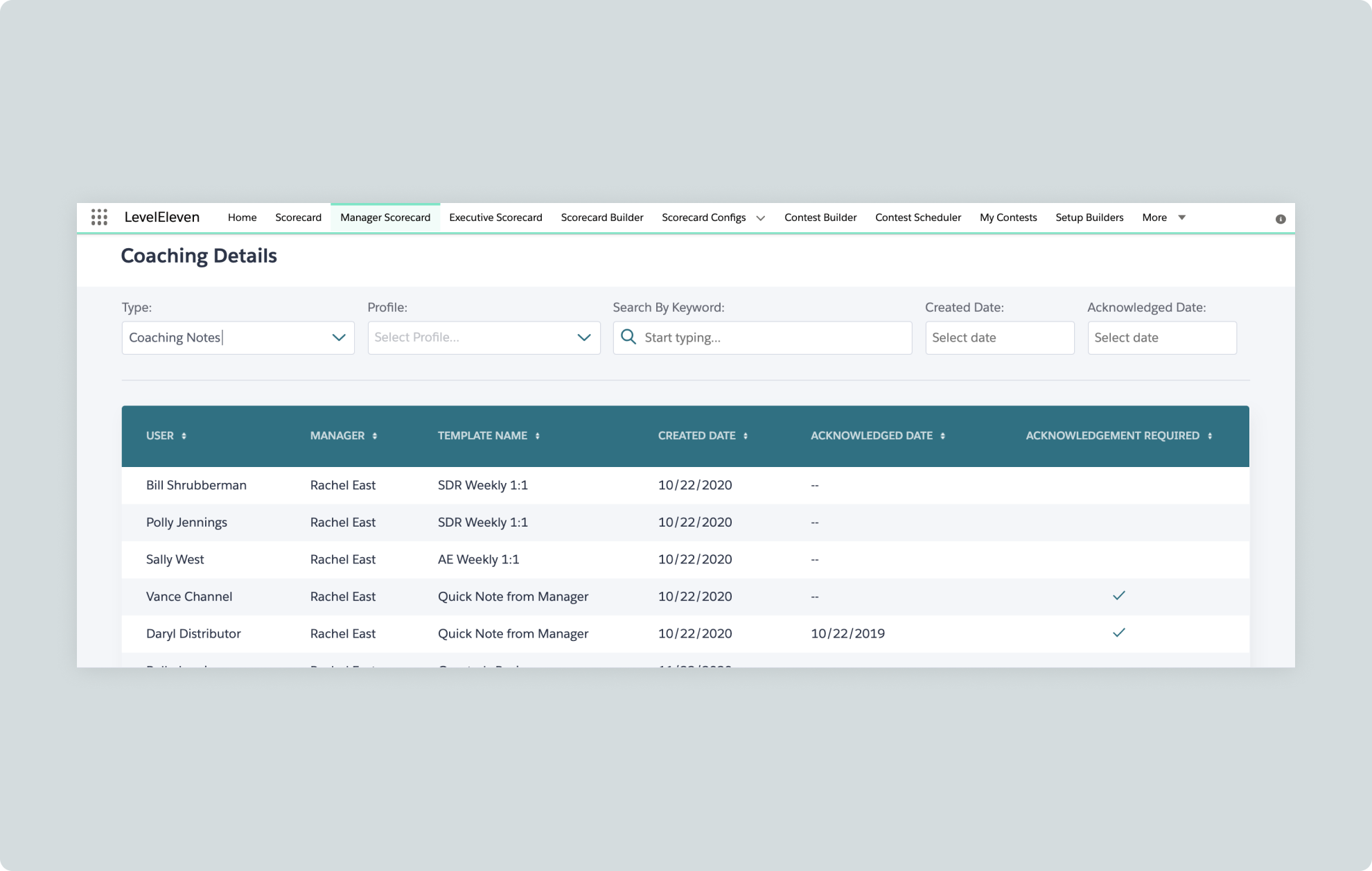

Use contests to grow your portfolio by engaging and motivating brokers and financial advisors to focus on the behaviors that drive results. LevelEleven ensures brokers and advisors know where they stand in relation to their goals as they gather assets in their territories. Geopointe helps you gain location-based insights that will allow you to analyze your business strategy and make decisions that drive productivity.

Financial Advisors & Mutual Fund Wholesalers

- Track and visualize target clients or AUM as well as schedule meetings on any device

- Keep track of sales activities to ensure you’re on pace to meet your goals and earn that commission!

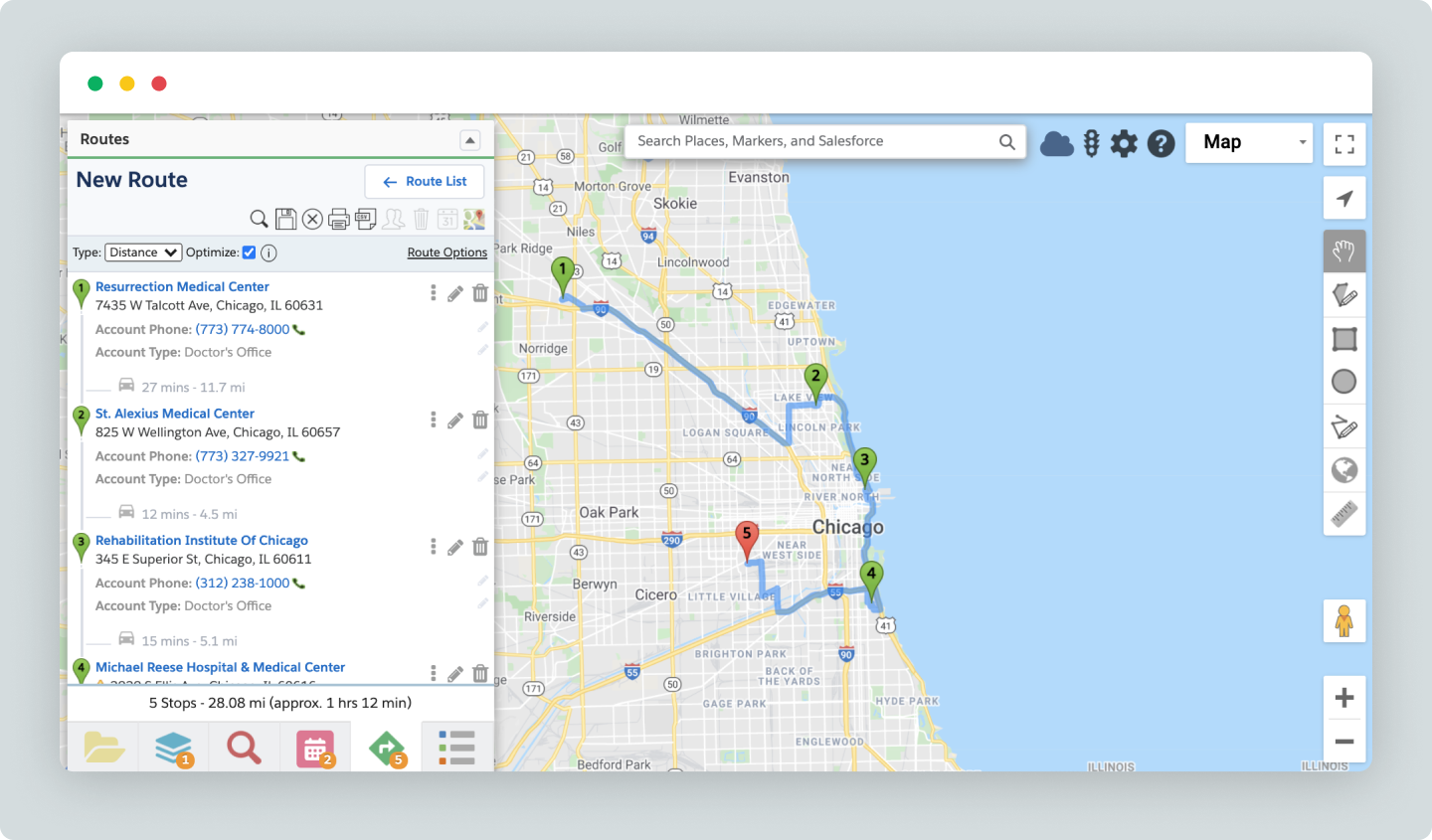

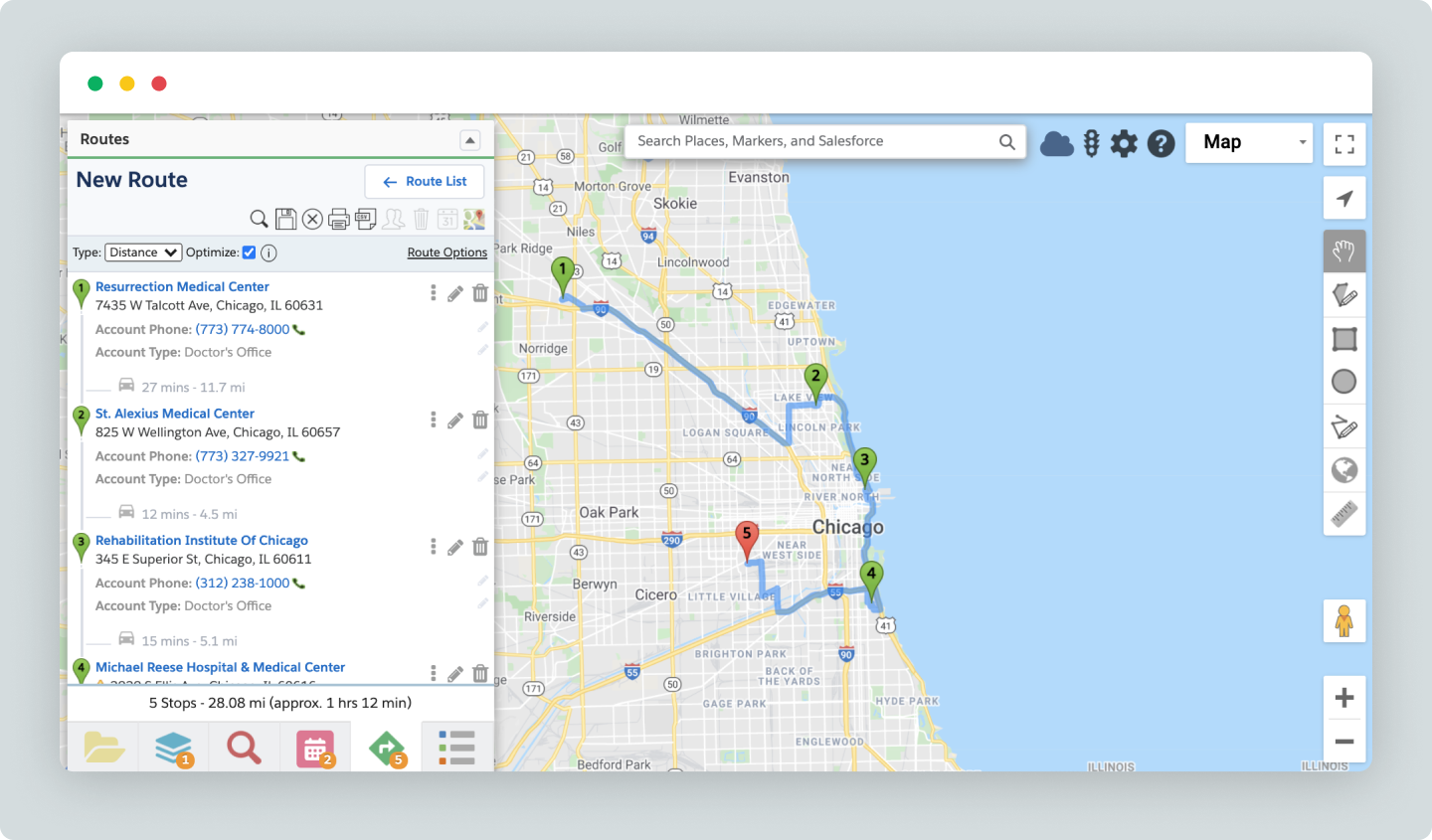

- Design trips around important meetings to maximize travel impact directly from the map in Salesforce

- Employ leaderboards and contests to motivate and engage advisors

- Visualize your target clients or households on the map, then use routing and optimization capabilities to create targeted routes and visit more clients per day

- Collaborate between internal and external wholesalers on travel planning and scheduling

Insurance Brokers

- Visualize policyholders, claims, and coverage within your territory to identify areas of growth and enhance existing client relationships

- Accelerate onboarding by performing mass updates directly from the map, giving new brokers visibility into their geographic territory

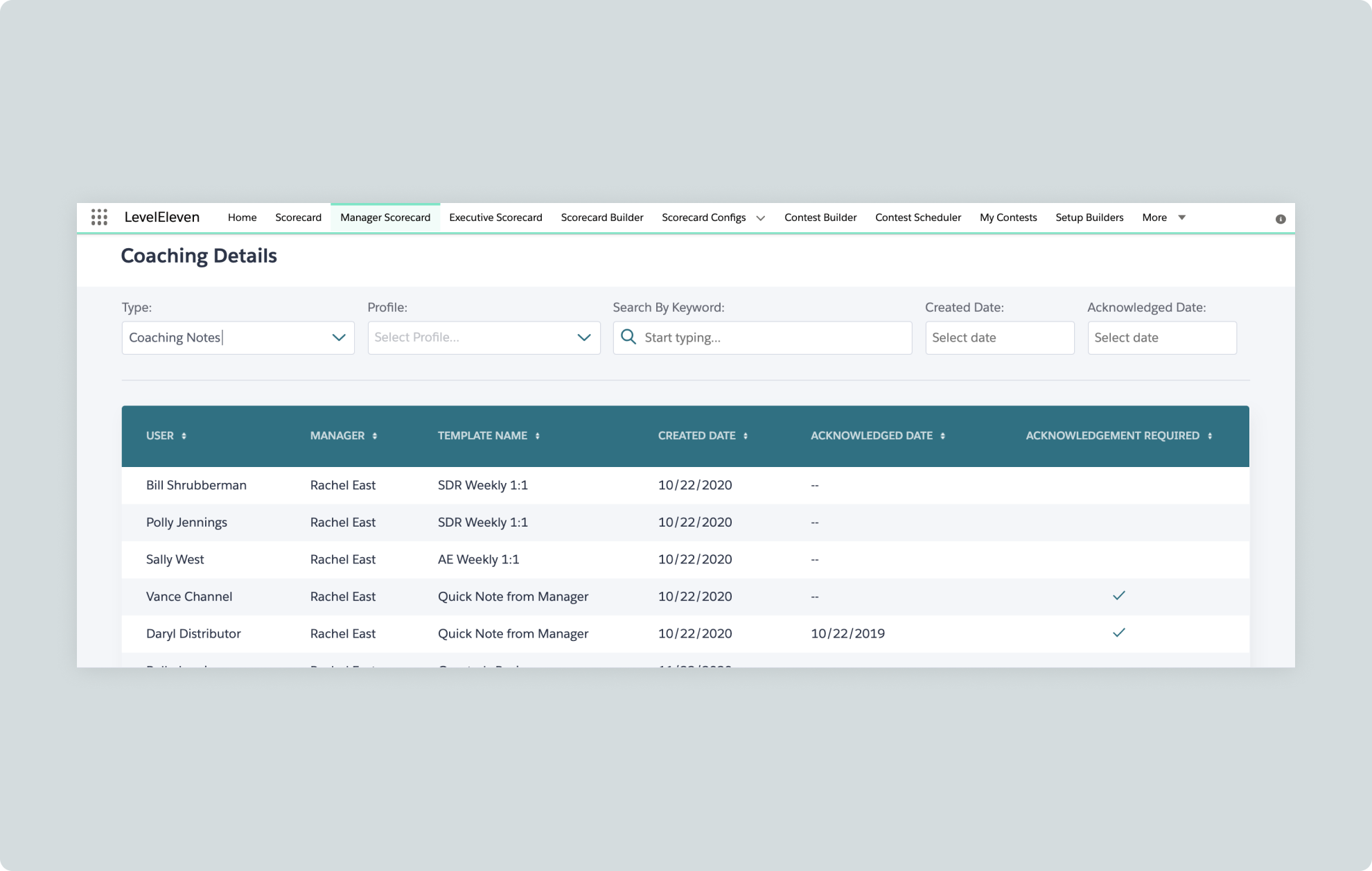

- Coach new brokers to success with LevelEleven Coaching

- Overlay weather conditions or demographic data to visualize and analyze concentrations of claims or policyholders using heat maps

- Utilize our “add to campaign” capabilities to execute geographically targeted calling or email campaigns

Banking: Retail, Commercial & Mortgage

- Provide an aggregate snapshot of all financial accounts with thematic mapping, giving bankers a better understanding of their customers’ and the broader households’ financial holdings at a glance

- Accelerate onboarding for new employees with Coaching

- Identify areas for growth by visualizing demographic data with heat maps

- Keep track of your goals and track progress with Performance Scorecards

- Visualize financial accounts, customers, or households within your territory and overlay with demographic data, identifying areas of growth and enhancing existing client relationships

- Efficiently schedule and optimize routes to client visits and bank representative rotations directly on mobile or desktop

- Forecast profitable branch locations and events based on client proximity or competitive presence